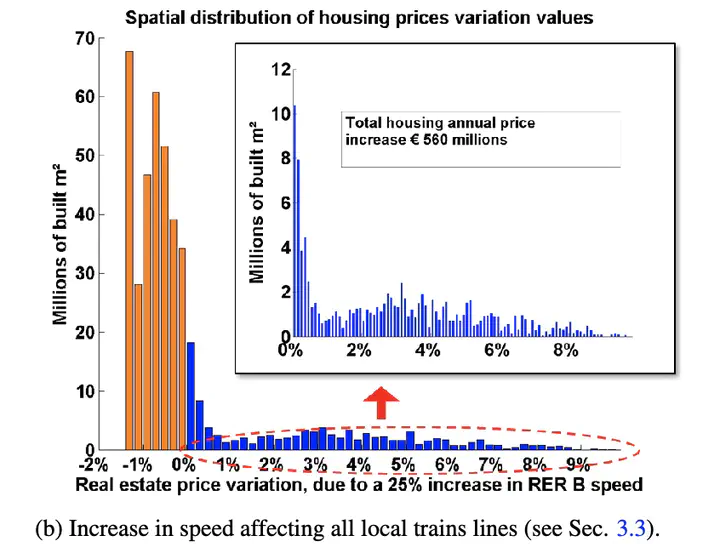

Abstract

In a context of rapid urbanization and energy transition, massive investments will be required to develop efficient public transport networks. Capturing the increase in land value caused by transport infrastructure (for exam- ple, through a betterment tax) appears a promising way to finance public transport. However, it is no trivial task, as it is difficult to anticipate the rent creation. This paper uses a simple city model based on urban economic theory to compute the rent created by improvements in public transport infrastructure in Paris, France. To apply in places where models or data are not available, a reduced form of the model is shown to provide acceptable approxima- tions of the rent creation. Simulations confirm that land value capture can finance a significant part of transport investments. The simulations also show that value capture potentials are influenced by what happens in the entire agglomeration. Simultaneous infrastructure investments in different parts of the city play a significant role, as they change overall accessibility patterns. Evolutions taking place in other cities also have a comparable influence. Non-local effects can change the total potential for land value capture and multiply this potential by as much as a factor of two.